Investment Highlights for ImmunoPrecise Antibodies Ltd

ImmunoPrecise Antibodies Ltd

#3204 4464 Markham Street

Victoria, BC

Canada V8Z 7X8

Phone: (800) 620-4187

https://www.immunoprecise.com/

You Might Also Like...

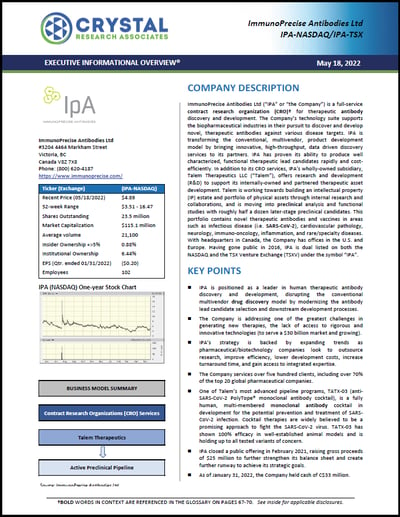

Investment Highlights for ImmunoPrecise Antibodies Ltd (IPA-NASDAQ/IPA-TSX)

- A full-service biologics Contract Research Organization (CRO) involved in therapeutic antibody discovery. The Company provides outsourced preclinical research within the biotechnology, pharmaceutical, and medical devices industries on a contracted basis.

- Greater demand for CRO services. There has been increasing demand for CRO service as pharmaceutical and biotechnology manufacturers seek greater efficiency and timely access to sophisticated technology and expertise. The CRO market is approximately $30 billion and growing. IPA’s CRO services include, but are not limited to, antigen target design and modelling, immunization, antibody discovery, characterization, optimization, and manufacturing.

- A leader in transgenic animal platforms. Over the past years, the Company has gained recognition as a leader in the biologics and CRO space with IPA Canada and IPA Europe, which have both been designated as approved CROs for the world’s leading transgenic animal platforms producing human antibodies.

- Offers a full suite of CRO services. The Company is likely to benefit from the growth in demand for outsourced services related to antibody discovery and development as it offers a full suite of CRO services within antibody optimization, engineering, and manufacturing—affording IPA with a substantial advantage. The Company is also expected to benefit from its internal product pipeline, which includes its COVID-19 antibody program (via its Talem Therapeutics subsidiary, see below).

- Top pharmaceutical companies are their clients. Working with 70% of the top 20 global pharmaceutical companies, IPA’s laboratory operations are carried out from three facilities—Victoria, BC (IPA Canada), as well as Utrecht and Oss in the Netherlands (IPA Europe).

- The Company continues to see an increase in the number of clients and the size of its contracts, while also recognizing revenue from recently developed and/or expanded services in areas such as high throughput label and fluidic-free antibody characterization, hybridoma sequencing, its advanced second generation B cell Select® platform, and the geographical expansion of its manufacturing services.

- The Company continues to realize the benefits from its new marketing approaches, tax incentive programs, and commercial partnerships, which are designed to provide catalysts for growth in both its contract research and Talem partnering relationships.

- IPA’s comarketing program with Eurofins is poised to position the Company on a global scale, highlighting the value of IPA’s unique suite of antibody products and services to industry-leading organizations, and setting the stage for its market narrative as the emerging leader in end-to-end services.

- Successful dual listing. A major step to unlocking long-term shareholder value has been IPA’s successful dual listing. Having gone public in 2016, IPA is dual listed on both the NASDAQ and the TSX Venture Exchange (TSXV) under the symbol “IPA”, enabling the Company to diversify its shareholder base with long-term retail as well as institutional investors from not just the U.S. but worldwide.

- Raised US$25 million. In February 2021, IPA closed a public offering in which it raised gross proceeds of US$25 million, strengthening the Company’s balance sheet and creating further runway to achieve its strategic goals. These goals include growing the presence within the CRO space, as well as ensuring a continual flow of internal candidates through functional and preclinical analysis toward potential out licensing and the continued launch of novel programs.

- At-the-market (ATM) Agreement. On October 13, 2021, the Company established an at-the-market equity offering facility, which entitles the Company, at its discretion and from time-to-time during the term of the ATM Agreement to sell, through its agent, H.C. Wainwright & Co, common shares of the Company having an aggregate gross sales price of up to US$50 million.

- Current Cash Position. As of January 31, 2022, the Company held cash of approximately C$33 million.

Talem Therapeutics Subsidiary

- IPA continues to develop internal and partnered therapeutic discovery programs through its Talem subsidiary. In pursuing this objective, Talem expects to continue to work with its current partners as well as others with which it may engage in the future on a number of research, development, and preclinical endeavors. Talem also expects to seek to expand its base of existing partners for novel research programs, as well as out-licensing and/or sales of internal assets.

- Talem is focused on advancing its pipeline candidates as it leverages its highly differentiated therapeutic antibody programs to potentially treat various disease areas. These include infectious diseases (i.e. SARS-CoV-2), cardiovascular pathology, neurology, immuno-oncology, inflammation, and rare/specialty diseases, and moving these candidates into preclinical analysis and functional studies.

COVID-19 Opportunity

- Since January 2020, Talem has been engaged in SARS-CoV-2 research. One of its most advanced development programs, TATX-03 (anti-SARS PolyTope® monoclonal antibody), is a fully human, synergistic, antibody cocktail containing potently neutralizing antibodies against non-overlapping epitopes on SARS-CoV-2.

- In February 2020, the Company launched its coronavirus vaccine and therapeutic antibody to address both the prophylactic (preventative) and therapeutic measures to fight SARS-CoV-2 through its Talem subsidiary.

- In March 2020, Talem announced the launch of TATX-03 PolyTope® monoclonal therapy, representing a treatment option for COVID-19 patients that is focused on broad protection to ensure efficacious treatment of patients even as the virus evolves.

- In July 2020, IPA was awarded a $1.5 million Bioscience Innovation Grant for Coronavirus Research from the North Dakota Department of Agriculture for the development of antibody therapeutics against SARS-CoV-2.

- IPA is developing its anti-SARS-CoV-2 PolyTope® monoclonal therapy, which utilizes characterized protein and antibody combinations aimed at targeting multiple epitopes and mechanisms of virus evasion in an effort to develop innovative therapeutics and vaccines against the COVID-19 virus.

-

- The Company’s PolyTope® approach is expected to provide a clinical benefit against both current and future variants and strains of the COVID-19 virus by combining well-defined and fully characterized, protective antibodies (for therapeutics) and epitopes (for vaccines).

- The Company’s PolyTope® approach is expected to provide a clinical benefit against both current and future variants and strains of the COVID-19 virus by combining well-defined and fully characterized, protective antibodies (for therapeutics) and epitopes (for vaccines).

- Using the Company’s proprietary B cell Select® and DeepDisplay™ technologies, Talem combines various SARS-CoV-2 spike protein forms anticipating that it will accelerate the anti-SARS-CoV-2 human antibody discovery by targeting multiple viral epitopes and mechanisms of viral evasion.

- The Company successfully demonstrated preclinical in vivo results for its TATX-03 PolyTope® Therapy, a four mAb antibody cocktail developed for the potential prevention and treatment of SARS-CoV-2. The preclinical study demonstrated potent pseudovirus neutralizing activity against the SARS-CoV-2 Delta (B.1.617.2) variant.

-

- Histopathology preclinical data from the TATX-03a Polytope® Program confirmed treatment substantially reduced bronchitis and tracheitis severity in preclinical studies.

- The Company released a publication entitled “Cornering an Ever-Evolving Coronavirus: TATX-03, a Fully Human, Synergistic, Multi-Antibody Cocktail Targeting the SARS-CoV-2 Spike Protein with in vivo Efficacy” on bioRxiv.

- Histopathology preclinical data from the TATX-03a Polytope® Program confirmed treatment substantially reduced bronchitis and tracheitis severity in preclinical studies.

- In January 2022, Talem filed a non-provisional U.S. patent application and concurrent PCT international and other national patent applications.

- On January 31, 2022, the Company released information on potent neutralization of the Omicron variant by its immunotherapeutic Polytope® and moves further towards FDA/IND-submission.

Partnerships

- IPA is advancing its partnerships, having previously announced deals with Pierre Fabre, Twist Biosciences, and Litevax during the fiscal year (described on pages 33-36), among others.

- The Company has expanded its partnership with Eurofins Discovery’s global clients, providing them greater access to IPA’s end-to-end antibody discovery capabilities using wild type and best-in-class in vivo and in vitro antibody discovery technologies that are optimized to deeply mine antibody repertoires.

- In developing IP intended to further drive its technology, both in efficiency and innovation, IPA has created a research partnership with Mila, a world-renowned research institute dedicated to artificial intelligence (AI) development and focused on deep learning optimization for AI and machine learning language. The partnership provides the Company with access to world-class specialists.

- Within the deep learning space, the Company is optimizing its next generation sequencing pipeline and evaluating in depth analysis and prediction tools for their integration into its platforms, while using innovative in silico approaches to enhance computer-aided antibody discovery and optimization.

Other

- The Company announced its CIR tax accreditation status to eligible French companies who engage with it in Europe. This added benefit to the full service advantage of IPA strengthens the Company’s platform of industry recognition and adds value to its ongoing expansion in France.

- IPA expects to continue to invest in employees, partnerships, cloud computing, data curation, and analysis to enable further work toward developing custom algorithms, cloud computing, large-scale sequence data analysis, and expanded access to next-generation sequencing technologies.

- IPA continues to build out on its global infrastructure, having completed the global rollout of its enterprise resource planning (ERP) and customer relationship management (CRM) systems during fiscal year 2021.

- IPA appointed Dr. Ilse Roodink to the Role of Chief Scientific Officer and Dr. Dion Neame to the Strategic Advisory Board.

- The Company further expects to add additional full-time employees to assist in portfolio management, out-licensing, and program oversight.

- IPA continues to build out on its global infrastructure, having completed the global rollout of its enterprise resource planning (ERP) and customer relationship management (CRM) systems during fiscal year 2021.

- The Company believes that its internal projects will ultimately drive transformative revenue generation opportunity for the Company through upfront payments as well as clinical milestones and competitive commercial royalties.

- IPA has shored up its financial strategy, having completed the final deferred payments and profit-sharing payments from prior acquisitions.